While there is no time limit to receiving Federal Direct Loans, there is a limit on the amount that students are eligible to borrow from the federal government. Dependent undergraduate students are eligible to receive up to $31,000 in federal direct loans in a lifetime, while the lifetime limit for independent undergraduate students is $57,500. Graduate students have a limit of $138,500 in their lifetime. Students can only borrow up to these limits, then they will need to look into other loan resources.

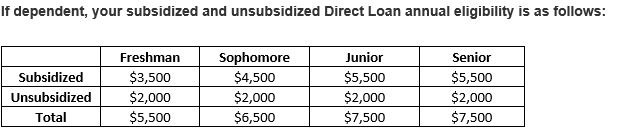

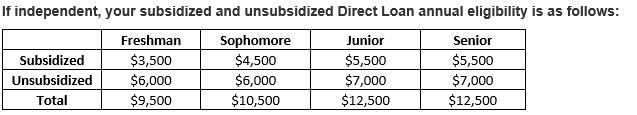

In addition to aggregate lifetime limits on federal direct loans, there are also limits to the amount that students are eligible to borrow each year.

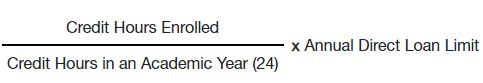

Per federal regulations, institutions are required to prorate loans for graduating undergraduate students if they graduate prior to the end of an academic year. This means, that if a student completes their degree program in the Fall semester, their loans will be prorated (adjusted) based on enrollment. The formula provided by the federal government is below.

In some cases, this proration may result in reduced loan eligibility, while enrollment may also result in increased loan eligibility.

For example, if a dependent undergraduate student is completing their degree program in the Fall semester and is enrolled in 8 credits, we will divide 8 credit hours enrolled by 24 credit hours in an academic year and multiply that number by the annual limit of each loan the student is eligible for. In this case, this student will be eligible for less than the usual $2,750 subsidized and $990 unsubsidized loans for the semester.

A dependent undergraduate student who is enrolled in 20 credits their final semester will receive more than the usual $2,750 subsidized and $990 unsubsidized loans for the semester.

Once the institution performs the calculation to determine a graduating student’s eligibility, the new amount of the loan will be applied to a student’s account.

If the calculation results in additional funds offered that the student does not wish to utilize, they can complete a loan change request through the goStockton portal. Click here to learn how to complete a loan change.

If additional funds are needed, students can explore additional loan options at stockton.edu/finaid.

*Please note: This rule only applies to undergraduate students. Graduate and Professional Students are not affected.