Update: The below information is now not applicable, as Federal Student Loan Debt Relief has been blocked. Applications are no longer being accepted and no applications previously submitted are being processed. We will update this site if any new information is provided by the U.S. Department of Education.

The U.S. Department of Education (ED) Tuesday (10/18/2022) announced the launch of the application for Federal Student Loan Debt Relief. This program provides eligible borrowers with federal student loan debt relief of up to $20,000 for Federal Pell Grant recipients and up to $10,000 to non-Pell Grant recipients.

Federal Direct Loans disbursed before June 30, 2022 are eligible for debt relief. Loans disbursed on or after July 1, 2022 are not eligible. The following types of loans are eligible for debt relief:

William D. Ford Federal Direct Loan (Direct Loan) Program loansFederal Family Education Loan (FFEL) Program loans held by ED or in default at a guaranty agencyFederal Perkins Loan Program loans held by EDDefaulted loans (includes ED-held or commercially serviced Subsidized Stafford, Unsubsidized Stafford, parent PLUS, graduate PLUS; and Perkins loans held by ED)

This means that subsidized loans, unsubsidized loans, parent PLUS loans, and graduate PLUS loans held by ED are eligible. Consolidation loans are also eligible for relief, as long as all of the underlying loans that were consolidated were ED-held loans and were disbursed on or before June 30, 2022.

Additionally, consolidation loans comprised of any FFEL or Perkins loans not held by ED are also eligible, as long as the borrower applied for consolidation before Sept. 29, 2022.

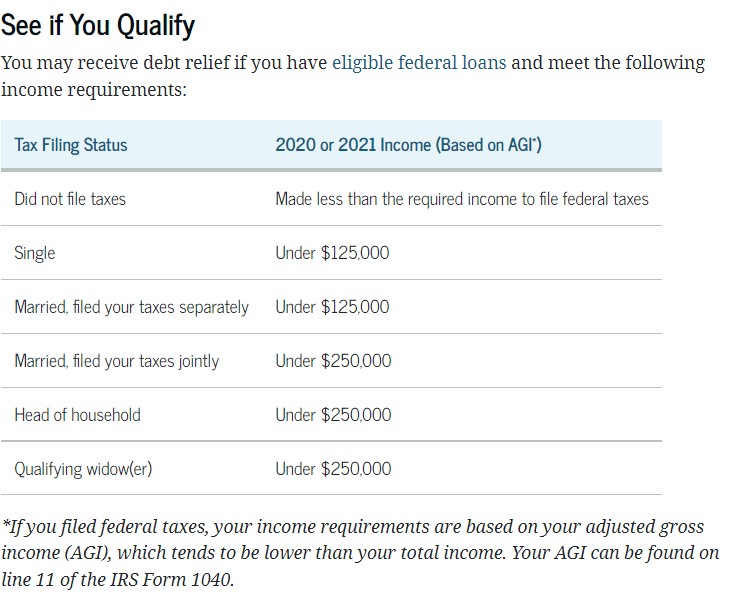

To qualify, individuals must have earned less than $125,000 in 2021 or 2022. Families must have earned less than $250,000 in 2021 or 2022. Anyone who filed federal taxes will report their AGI as their income on the application. See the chart below to view income criteria for your circumstance:

Please note, individuals or families must only meet the income requirement for one of the two years (2021 or 2022) to qualify.

Students who are considered dependent for Federal Student Aid purposes are eligible for the same amount of debt relief, but eligibility is based off of both parent’s income, not the student’s income.

Dependent students who complete the application should use their own income information to complete the form. When ED identifies a student as dependent, the student will receive an email with instructions on next steps for the student and the parents.

Parents with their own federal loans, including those who borrowed PLUS Loans on behalf of their children can also apply. Applications will be processed separately from your children, so parents will need to submit their own application.

Borrowers can apply for Federal Student Loan Debt Relief on the Federal Student Aid website at https://studentaid.gov/debt-relief/application. No login is required. Borrowers should apply now, but no later than December 31, 2023.

The form is available in English and Spanish on both Desktop and Mobile versions. A paper version of the application will be made available for those who cannot complete the online application.

Any borrower who completed the Beta version of the application, where borrowers could complete the application before it’s official launch will have their application processed and will not have to complete another through the official launch.

After a borrower applies, they will receive an email confirmation that ED has received their application. Please note that studentaid.gov will not update at this time. Next, ED will review the borrower’s application and will contact the borrower if any additional information is needed. No further action is needed if the borrower does not hear back from ED.

ED will then notify the borrower once their eligibility has been confirmed and will work with their loan servicer to apply the debt relief to the borrower’s account. Your servicer will contact you once your debt relief has been applied to your account.

Although the federal loan payment pause has been in effect since March 13, 2020, so borrowers have continued to make voluntary payments on their loans. Anyone who made voluntary payments to their federal loans between March 13, 2020 and December 31, 2022, and their current loan balance is below the amount of debt relief they’ll receive, after they successfully apply for Federal Student Loan Debt Relief, ED will automatically refund the amount they paid during the payment pause (only up to the amount of their eligible debt relief).

To view current federal borrowing history as well as loan servicer information, borrowers can log in to studentaid.gov with their FSA ID and Password. If a borrower does not have an FSA ID and Password, they can create one on studentaid.gov as well.

For questions, please contact Federal Student Aid at 1-833-932-3439.

Source: https://studentaid.gov/manage-loans/forgiveness-cancellation/debt-relief-info