Manually inputting your financial information into the FAFSA? Try using the IRS Data Retrieval Tool (DRT) instead!

Manually inputting your financial information into the FAFSA? Try using the IRS Data Retrieval Tool (DRT) instead!

Why is it important to use the tool?:

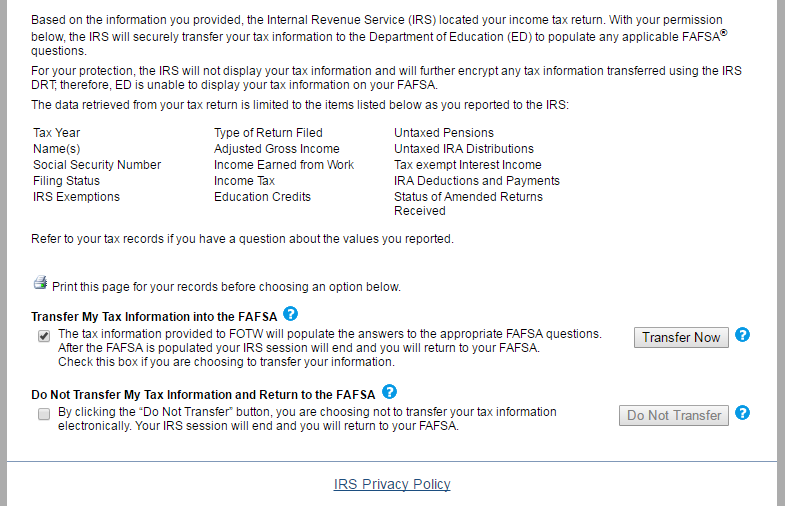

The DRT pulls much of your financial information directly from the IRS and inputs it into the FAFSA for you. Not only is the information considered accurate and verified, but it also makes it easier for you since you won’t have to manually input a lot of financial information into the FAFSA!

Once you use the DRT, it is important that you do not make any changes to the information that was transferred from the IRS. If you make any changes, the information will be considered invalid.

Using tool also decreases your chances for being selected for federal verification. Some students who are selected for verification are required to use the tool to complete the process. To see if you were selected for verification or have outstanding requirements, visit stockton.edu/verification to learn more.

How to use the tool:

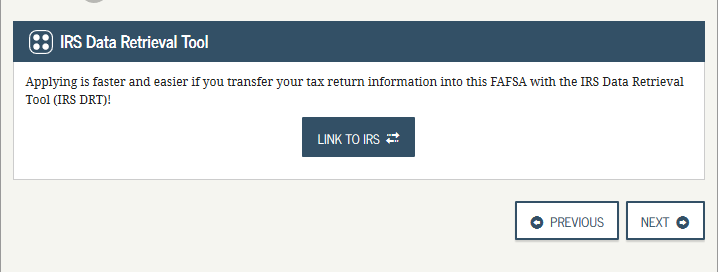

To use the DRT, you must log in to your FAFSA and within the application, click the financial information tab. Within that tab there will be a student option as well as a parent option for dependent students. For the student, click through until it gives you the option to link to the IRS.

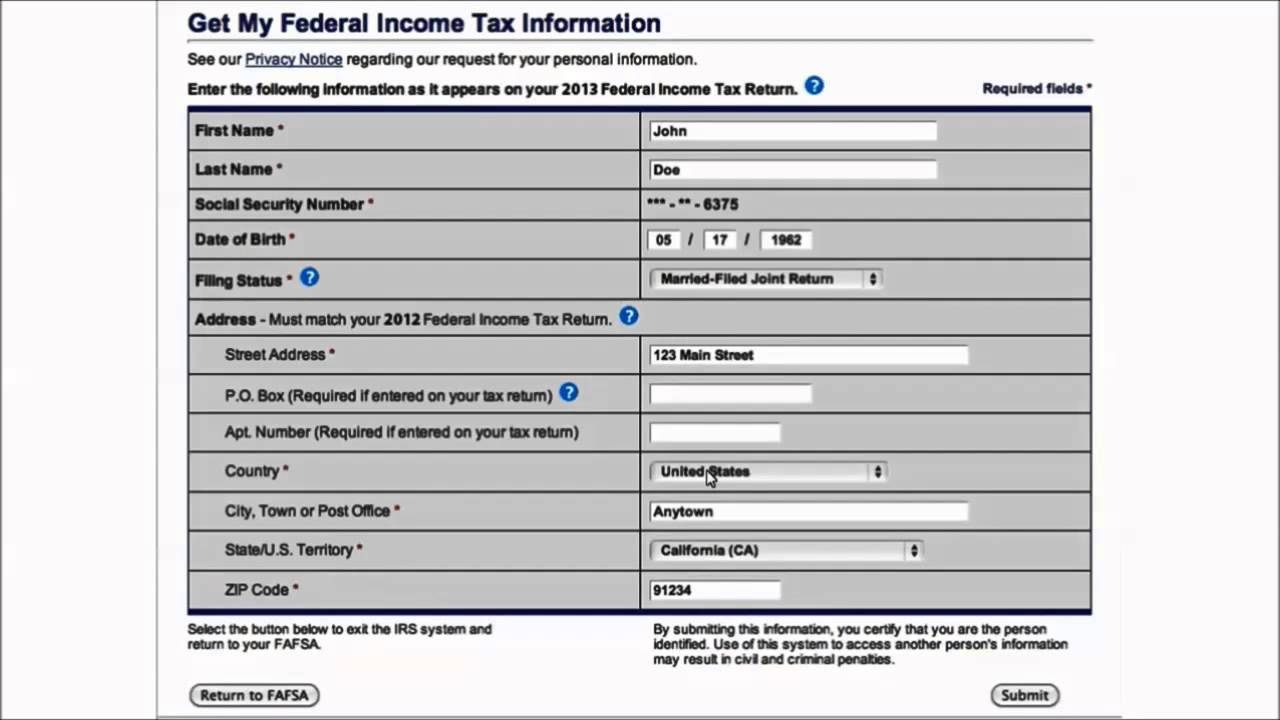

Click the link to IRS button and then click proceed to IRS site. Agree to the terms and input the address you used to file for the appropriate year. Once you input the information, click submit.

Then, click the checkbox that says transfer now and click the transfer now button. Once the information is transferred, it will bring you back to the FAFSA.

For dependent students, click through the parent section of the financial information section on the FAFSA until you see the link to IRS button. Click link to IRS and enter the parent FSA ID and password. Agree to the terms and input the address you used to file for the appropriate year. Once you input the information, click submit. Then, click the checkbox that says transfer now and click the transfer now button. Once the information is transferred, it will bring you back to the FAFSA.

If you are doing the FAFSA for the first time, you need to finish the remainder of the application. If you are making a correction because you need to use the tool for verification purposes, you need to re-sign and submit the application.

What happens if you keep getting an error message?

If you keep getting an error message, the IRS could have a different version of your name, filing status or address. Even if you are inputting the information correctly, if it does not match the information that the IRS has in their system, you will not be able to link with that information. You may need to try to abbreviate addresses, remove hyphens, etc. If you are still unsuccessful, you may enter the information manually. If selected for verification and you are still unsuccessful, you may be able to upload your Tax Return Transcript for the year you are working on as an alternative to complete the verification process.

Above all, using the DRT makes filling out the FAFSA easier and most accurate. Make sure to take advantage of the opportunity if you can!

If you file married separately or are recently divorced and during the aid year you are working on, you filed a joint return, you will not be able to use the DRT. If you are selected for verification, you must provide your tax return transcript for that year and your W2’s for the same year.

If you have additional questions, feel free to contact us!